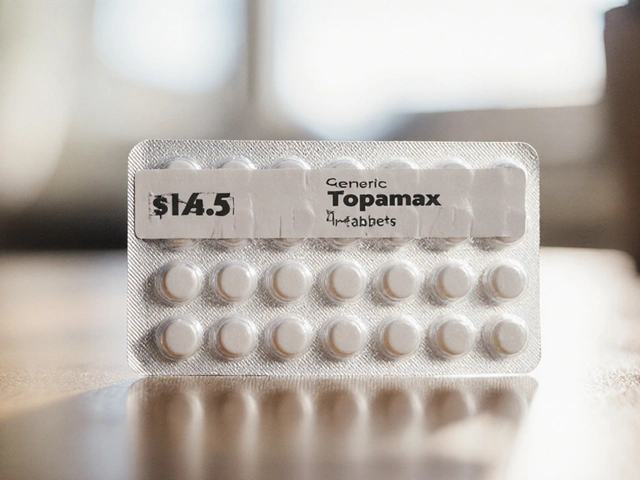

Choosing between a generic and brand-name drug isn’t just about the pill in your hand-it’s about what you pay at the pharmacy counter. In 2024, the difference in copays between these two types of medications can be massive. For many people on Medicare or private insurance, a generic drug might cost just $4.50, while the brand version could set you back $100 or more for the same 30-day supply. That’s not a typo. And it’s not rare.

How Copay Tiers Work in 2024

Most prescription drug plans in the U.S. use a tiered system. Think of it like a pricing ladder. The lower the tier, the cheaper the drug. In 2024, the standard structure has four or five tiers:- Tier 1: Preferred generics - often $0 to $5

- Tier 2: Non-preferred generics - usually $5 to $10

- Tier 3: Preferred brands - median $47

- Tier 4: Non-preferred brands - median $100

- Tier 5: Specialty drugs - $150 to over $5,000 per month

Medicare Part D vs. Private Insurance: Big Differences

Not all plans work the same way. Medicare Part D plans fall into two main types: Medicare Advantage Prescription Drug (MA-PD) plans and standalone Prescription Drug Plans (PDPs). The way you pay matters.- MA-PD plans: 97% use fixed copays. You know exactly what you’ll pay each time you refill. Preferred brand? Around $47. Non-preferred? $100.

- PDPs: 89% use coinsurance instead. That means you pay a percentage of the drug’s full price. For a $200 brand-name drug, 22% coinsurance = $44. But if the drug jumps to $500? You’re paying $110. No cap. No predictability.

Why Generic Copays Are So Low (and Sometimes Too Good to Be True)

You might think $0 or $5 for a generic sounds like a gift. But here’s the catch: those low prices don’t always reflect the real cost of the drug. A 2024 report from the Medicare Payment Advisory Commission (MedPAC) found that generic drug prices at pharmacies can vary wildly-from $3 to $20 for the same pill-depending on the pharmacy, the wholesaler, and even the time of year. Some wholesalers have “tying arrangements” with pharmacies: if you agree to stock expensive brand-name drugs, they’ll give you cheaper generics. But that doesn’t mean the savings get passed to you. In fact, independent pharmacists say these deals often inflate the price of generics just enough to make the math work for the wholesaler-not the patient. And here’s something else: even with $0 copays, you’re still paying indirectly. The plan’s overall cost gets baked into your premiums. So a plan with $0 generics might charge $150/month in premiums, while one with $5 generics might charge $80. You’re trading upfront cost for long-term cost.Brand Name Drugs: When You Have No Choice

Not everyone can switch to a generic. Some people have severe side effects with generics-even though they’re supposed to be bioequivalent. Others take complex combinations where the brand is the only version that works with their other meds. A 2024 survey by the Medicare Rights Center found that 63% of people taking brand-name drugs struggled to afford them. Only 28% of generic users said the same. One Reddit user wrote: “I’ve been on my brand-name asthma inhaler for 12 years. My doctor won’t let me switch. My copay is $95. I skip refills to make it last.” The Inflation Reduction Act helped a little. Insulin is now capped at $35 per month-no matter if it’s brand or generic. But for most other brand-name drugs, that $100+ copay is still the norm.What You Can Do Right Now

You don’t have to just accept these prices. Here’s what actually works:- Check your plan’s formulary. Every plan must publish it by October 15 each year. Look up your exact medications-not just the name, but the dose and manufacturer.

- Use the Medicare Plan Finder. Type in your drugs. Compare plans side by side. A plan with a $5 generic copay might cost you $1,200 a year for a brand drug. Another with a $40 brand copay might only cost $480. Don’t guess-calculate.

- Ask about therapeutic alternatives. 72% of Medicare plans have a cheaper generic version for at least 80% of common brand drugs. Your doctor might not know. Ask: “Is there another drug in the same class that’s covered better?”

- Use cash prices. Sometimes, paying cash at Walmart or Costco is cheaper than your copay. Use GoodRx or SingleCare to compare. One user saved $70 on a generic statin by paying $12 cash instead of using insurance.

- Consider professional help. A Medicare counselor can review your meds and find savings. They charge $75-$150, but the average savings? $420 a year.

What’s Changing in 2025

Big changes are coming. Starting in 2025, there’s a hard cap: you’ll pay no more than $2,000 out of pocket for all your drugs in a year. That’s huge. Right now, people on expensive brand drugs can hit $8,000 in spending before catastrophic coverage kicks in. After that, they still pay 5%-which could be hundreds a month. By 2025, 98% of Medicare Part D plans will offer $0 preferred generic copays. That’s up from 87% in 2024. But non-preferred brand copays are expected to rise to $105. So while generics get cheaper, the high-end brand drugs are getting more expensive. The goal? To protect people from financial ruin. But it also means insurers will push even harder to get you on generics. If you’re on a brand you can’t switch from, you’ll need to plan ahead. The $2,000 cap helps-but only if you track your spending.Real Numbers, Real Impact

Let’s put this in perspective:- Generic drugs make up 92.7% of all prescriptions but only 17% of total drug spending.

- Medicare spent $1,027 per person on generics in 2023. On brand drugs? $7,842.

- For someone taking one non-preferred brand drug at $100/month, that’s $1,200 a year. The same drug as a generic? $54.

- One person taking three brand-name drugs at $100 each? $3,600 a year. That’s more than many people spend on rent.

Why is my generic drug more expensive than the brand?

It’s rare, but it can happen. Sometimes, the brand-name drug has a discount program or coupon that lowers its price below your insurance copay. Or your pharmacy’s wholesale price for the generic spiked due to supply issues. Always check cash prices with apps like GoodRx. If the cash price is lower, pay cash and skip your insurance.

Can I switch from a brand to a generic without my doctor’s approval?

Your pharmacist can usually substitute a generic unless your doctor wrote “dispense as written” on the prescription. But even then, your insurance might still charge you the brand copay unless you ask for a prior authorization or exception. Always call your plan first. Don’t assume your pharmacist will know your plan’s rules.

What if I can’t afford my brand-name drug and there’s no generic?

Ask your doctor about therapeutic alternatives-other brand-name drugs in the same class that might be cheaper on your plan. You can also apply for patient assistance programs from drug manufacturers. Most big pharma companies offer free or discounted drugs to people who qualify based on income. Websites like NeedyMeds.org list these programs.

Does the $35 insulin cap apply to all insulin types?

Yes. The $35 monthly cap applies to all insulin products covered under Medicare Part D, whether they’re brand-name (like Humalog or Lantus) or generic. This cap also applies to many private insurance plans that adopted it early. It’s one of the few areas where brand and generic pricing is now equalized.

How do I know if my plan is good for my medications?

Don’t look at monthly premiums alone. Use the Medicare Plan Finder or your insurer’s online tool. Enter every drug you take-exact name, dose, and frequency. Then compare total annual costs: copays + premiums. A plan with a low premium but high brand copays can cost you more than a pricier plan with low copays. Most people save money by choosing based on actual drug costs, not premiums.

jonathan soba

January 27, 2026 at 19:00

Let’s be real - this whole tiered system is just pharmacy roulette. You think you’re saving money with generics, but half the time the generic is made by the same company as the brand, just repackaged with a different label. And don’t get me started on how insurers game the system to push you toward the most profitable generics, not the safest ones.

It’s not about health. It’s about balance sheets.